Quick Chat

with you!

You have our ear and we can't wait to hear about your idea! Share your details here and we will make sure to schedule a coffee date with you soon.

“Can your bank hear you?” Voice-based banking integrated with artificial intelligence is no longer a dream, but an increasingly necessary concept in Australia, where accessibility and security are driving the growth of fintech. As digital transactions are increasing by more than 25 percent every year, customers need convenient but secure solutions. And this is where artificial intelligence software development is making waves, enabling banks to offer safer and more innovative voice recognition services. 7 Pillars is your trusted fintech app development partner for innovative digital banking solutions.

As a means to develop inclusive platforms that accommodate the needs of the visually impaired, curb fraud, and simplify authentication, collaboration with a fintech app development company provides a way forward for businesses in Australia. Accessibility and sophisticated fraud detection will help financial institutions to stay relevant in the changing digital economy.

This blog will discuss how voice banking solutions use artificial intelligence software development, how to establish a reliable partnership with a reliable fintech app development company, and why Australia will be a hub of safe, AI-driven financial applications in 2025.

In Australia, startups, technology founders, and existing businesses have an essential task in making the correct technology to use with mobile applications. Companies that specialize in the unique React Native app development technology are attracting many people, as they desire to create high-performance applications that come with a compromise in speed and functionality.

Meanwhile, other businesses are interested in finding a progressive web app development company to increase the coverage without increasing the development expenses. This blog helps Australian businesses navigate their growth path by comparing frameworks, strategies, and performance to determine the most effective direction to take.

Voice banking is transforming fintech by combining AI technology with safe and convenient experiences. Customers are now able to check balances, transfer money, and receive financial advice by voice command. Voice banking in Australia: AI for accessibility and security is becoming one of the key areas of innovation as Australia moves towards its digital economy.

This provides sufficient opportunity for any artificial intelligence software development firm in Australia to incorporate high-tech capabilities, such as natural language processing, multi-factor authentication, or blockchain technology integration, into the banking system, thereby increasing the trust and usability of the banking system in today’s world.

Voice banking is gaining popularity in Australia due to its innovative technology, legal protection, access benefits, and new fintech innovations.

3. Which Australian Banks Are Using Voice Banking?

3. Which Australian Banks Are Using Voice Banking?With more innovative, personalized, and accessible voice solutions, AI is transforming voice banking by enhancing user interaction, communication, and security.

Due to AI software development, voice banking picks up speech patterns, emotional coloring, and tone. This AI software maintains a more accurate vocal identity compared to generic text-to-speech systems.

Voice banking is a strong AI program, particularly among individuals with ALS or other related conditions. With a fading speech, an AI application can speak on behalf of people, enhancing social interaction and alleviating frustration.

Voice models are stored and accessed securely through the use of secure AI to support Accessibility and Security protocols. Voice data is safeguarded by AI technology that can verify and encrypt the information before it is misused.

A practical AI application is embedded in a support system or a device. AI software development makes sure that all smartphones, tablets, and smart homes are compatible.

New voice banking systems are designed to make the digital communication process more human, holistic, and tailored to each individual’s specific needs.

4. Secure Cloud Storage With Artificial Intelligence

4. Secure Cloud Storage With Artificial Intelligence Voice banking in Australia offers fintech solutions based on AI to enhance accessibility, provide high-level security, and offer self-service financial solutions through conversational technology.

Banks combine biometrics with multiple layers of checks, such as voice recognition. In this case, immutable authentication data may also be logged using blockchain technology.

Conversational AI also allows users the ability to pay bills, check balances, or seek financial advice using natural language. An experienced app development firm will guarantee that voice recognition models have very few errors.

Aged Australians and those with vision impairments gain a lot. The mobile app development company in Australia can streamline user flows in an inclusive direction.

The use of voice biometrics in conjunction with APRA compliance ensures the safety of digital transactions. Fraud-detection AI models are increasingly getting used in financial app development solutions. We deliver the best fintech app development services for secure and scalable financial platforms.

A fintech app development company develops voice-enabled applications and digital wallets, robo-advisors, and ecommerce solutions as an end-to-end system.

Hybrid banking apps are commonly created using tools like Ionic App Builder by app developers who need to build apps that offer a consistent experience on iOS, Android, and the web.

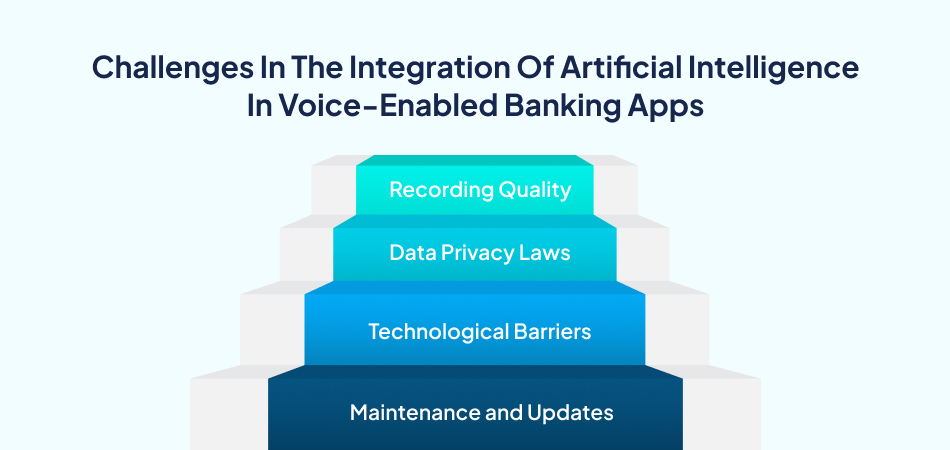

Voice banking is not the answer, even as it promises to be one, as there are privacy issues and technical difficulties on demand app developers have to overcome to allow more people to use it.

Background noise or poor signals will reduce the performance of an AI application. A voice capture needs to be clear to ensure natural-sounding AI apps.

According to strict data protection laws in Australia, user consent is required. Accessibility and Security AI must comply, making it challenging to create AI software.

A lack of access to smartphones or good microphones impedes adoption. The evolution of artificial intelligence software development should cater to the needs of users with limited resources and support offline AI applications.

AI technology evolves rapidly. Maintaining AI applications in a secure and updated state requires constant AI software development and maintenance.

With the pace of innovation increasing, voice banking in Australia has a promising future, featuring more innovative tools, enhanced access, and improved integration of AI.

The next generation of AI applications will also have proactive conversation capabilities, which predict user needs by prompting them with potential phrases or calling them based on enhanced AI Accessibility and Security.

Voice banking will have access to a larger number of Australians as the cost of AI software drops. The AI application can be as ubiquitous as the messaging applications, and it can promote the availability of voice services in remote locations.

AI can be integrated with healthcare platforms, aligning voice models with hospitals during medical consultations, ensuring compliance and confidentiality through embedded AI in the context of Accessibility and Security.

As Australia is a diverse country, AI will be used to support various languages and accents, whereby the voice banking app will automatically detect the language or dialect used.

One of the most prosperous banks in Australia, Westpac, introduced AI-enabled voice banking as pilot technology to enhance access and security.

They collaborated with one of the biggest fintech app development firms to create a secure voice interface embedded in mobile apps.

The project also allowed customers (including the visually impaired) to be able to check balances and transfer money. The partnership with experienced app developers demonstrated how artificial intelligence can enhance inclusivity and safety throughout the digitized banking sector in Australia.

Artificial intelligence, voice banking, and safe fintech solutions are changing the future of Android app development in Australia. Through the employment of experienced application developers, companies can have an edge over their rivals by providing knowledge and experience in the local market.

It could be to improve accessibility, to maintain compliance, or to create more innovative user experiences. Still, in any case, the Android app development role is more essential than ever before. Through collaboration with trusted app developers, your business will be able to scale without fear. Ready to innovate? Stay with us in the future.

Q 1. What is voice banking in Australia?

Ans 1- Voice banking is an AI application that enables customers to conduct transactions and access financial services by speaking with it.

Q 2. How does it benefit banks?

Ans 2- It also increases access, makes things safer, and reduces dependence on manual processes, making operations more efficient.

Q 3. Can it work across platforms?

Ans 3- Yes, a development firm that creates progressive web applications or an expert team of iOS app developers can easily add voice functionalities to banking apps.

Q 4. Is voice banking secure?

Ans 4- Absolutely. Using AI-driven biometrics and compliance, iOS application developers create apps with a high level of fraud protection.