Quick Chat

with you!

You have our ear and we can't wait to hear about your idea! Share your details here and we will make sure to schedule a coffee date with you soon.

In the current digital banking era, financial fraud is growing at a pace never seen before, costing Australians in excess of $3 billion each year, according to the ACCC. Artificial intelligence software development has therefore become a vital investment for fintech disruptors. With AI algorithms detecting anomalies in real-time, banks can now flag fraudulent transactions before they occur. Banks rely on AI application development services to build smarter fraud detection systems and enhance transaction security.

The Australian financial technology sector has undergone a shift, and machine learning application development services can help in the development of intelligent, self-aware banking applications. The solutions evolve constantly, enhancing fraud detection algorithms and making financial systems smarter and more secure.

The blog discusses artificial intelligence software development and the impact of machine learning applications on financial security in Australia. It involves fraud detection, customer trust, and compliance with modern banking application solutions.

This understanding will support companies that want to modernize their fintech offerings and enhance the security of their transactions. Businesses can also build machine learning applications that identify fraudulent behaviour at any moment, generating self-optimizing systems.

In the meantime, artificial intelligence software development enables banks to automate data analysis, simplify risk management, and increase user trust levels and predictive accuracy. Collectively, these technologies reveal what fintech leaders do and how machine learning app development teams are propelling the Australian digital transformation.

The Rise of Intelligent Banking Apps in Australia With ML Development

The Rise of Intelligent Banking Apps in Australia With ML Development Banking applications have been the pillar of Australia’s digital finance environment, providing secure and easy methods of handling money. With smartphone usage in Australia exceeding 93%, mobile platforms are becoming the go-to for customers to use for payments, transfers, and investments. With this expansion comes the pressing demand for security, machine learning development and AI app development, which are revolutionizing fraud detection systems.

Such firms integrate machine learning app development services with sophisticated data modelling to detect threats before escalation.

The Australian finance sector is embracing AI not only to innovate but also to meet stringent laws on fraud and data privacy prevention.

3. Industry Adoption: AI in Action at Top Australian Fintechs

3. Industry Adoption: AI in Action at Top Australian Fintechs In the past, banks used rule-based systems, pre-set limits, blocklists and manual review flags. Examples include flagging it if the transaction is above 10000$, and blocking it if the IP origin is in the blocklist. But fixed rules are strict and prone to being manoeuvred by cheaters. They tend to produce a lot of false positives, overloading human analysts.

By introducing the concept of Artificial Intelligence applications to the system of fraud detection, it becomes possible to learn dynamically from the information. Models trained via machine learning app development to differentiate between patterns and suspicious ones. These systems evolve with time as methods of fraud change. In practice:

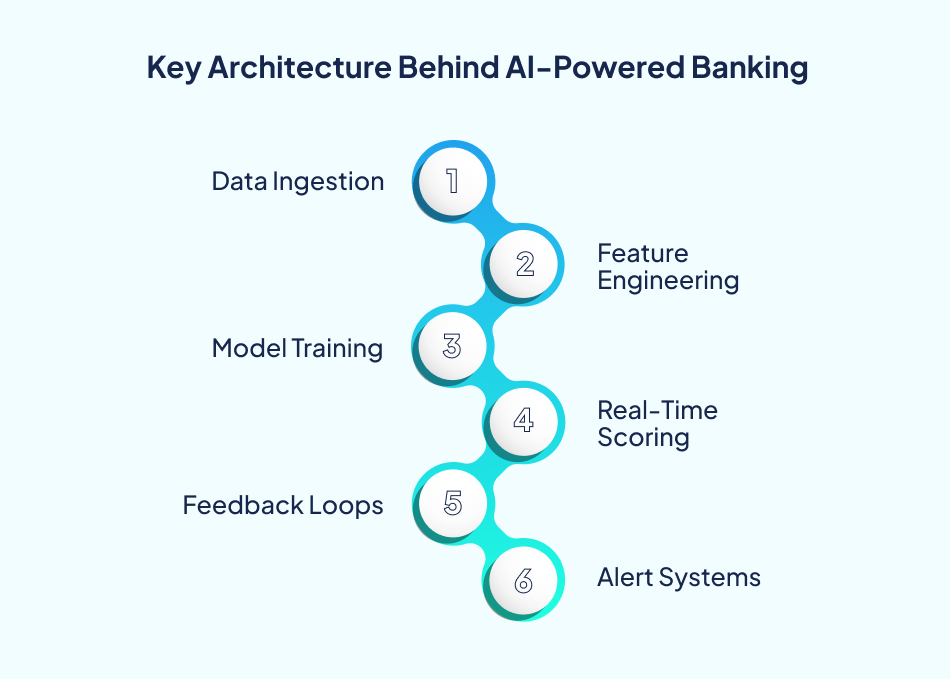

To build robust AI-driven fraud detection systems, a systematized process of integrating data engineering, machine learning, and continuous enhancement is required. To create such systems, AI software development teams generally assemble the following:

Raw transactional data, user records, device records, and external data sources (blocklists, known fraud records) are cleaned, adjusted, and transformed. A machine learning development company can help bring interactive elements to your app.

2. Feature Engineering & Selection With ML Development

2. Feature Engineering & Selection With ML Development The derivation of useful features (e.g., transaction velocity, average spends, geospatial consistency) is the key to successful models in machine learning app development. Modern AI-powered banking solutions improve trust by identifying suspicious transactions instantly.

Models learn between fraudulent and legitimate patterns using supervised or hybrid methods. Validation achieves good accuracy, low false positives and robustness.

A production inference layer is linked to banking applications and scores every transaction. The Android application development and maintenance of such engines is where machine learning app development services come in.

New fraud cases emerge, and labels are to retrain and tune models. There should be continuous improvement.

Depending on the fraud scores and risk limits, the system issues alerts, blocks accounts, OTP messages or offers them for human review.

Artificial Intelligence applications, including neural networks, ensemble techniques, graph analytics, and anomaly detection methods, are utilized throughout.

There are numerous benefits to applying fraud detection through AI and ML:

Formal regulations are crass. AI applications facilitate refinement to eliminate false alarms that irritate customers.

As customers make transactions, decisions can occur in milliseconds with machine learning app development, preventing fraud before it impacts accounts.

Fraud patterns shift. AI applications are constantly learning new data, keeping pace with new attacks.

4. Cost Efficiency & Scalability With ML Development

4. Cost Efficiency & Scalability With ML DevelopmentThe cost of manual review is high. Scaling AI software development through millions of users can be done without a linear increase in price.

Fewer false blocks, quicker resolution, and improved security boost user satisfaction.

The machine learning app development services facilitate cross-platform integration of web, mobile, API, and even voice banking, providing a single fraud perspective.

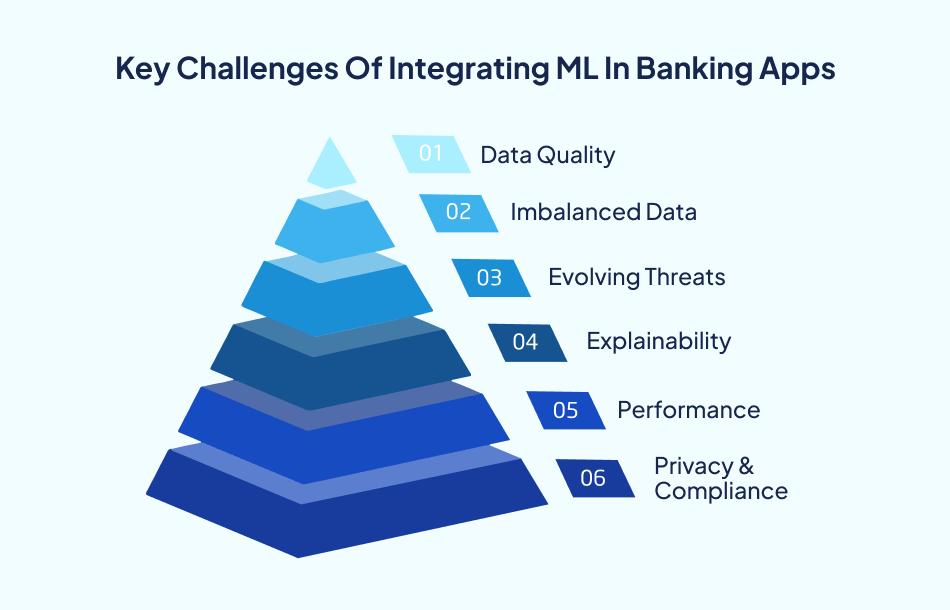

Notwithstanding this optimism, there are pitfalls when implementing AI/ML fraud systems:

The models used in training need a clean and well-labelled history of fraud. Fraud labels can be tardy or scarcely any.

Class imbalance is caused by an extremely low number of fraudulent transactions relative to normal ones, making it challenging to develop machine learning apps.

Scammers are ever-evolving. Models created with AI software development may quickly become stale without retraining. A cross-platform app development company can train algorithms to enhance your app.

4. Explainability Interpretability

4. Explainability InterpretabilityEven black boxes are possible, even with the most complex models (e.g. deep neural networks). Nevertheless, banks must have clear definitions, especially those of regulatory compliance.

Banking apps require optimized inference pipelines to support real-time scoring. The services of machine learning app development can add latency to poorly designed applications.

Regulatory attention has drawn attention to sensitive consumer data (e.g. GDPR, local banking legislation). The challenge of enforcing privacy but permitting Artificial Intelligence applications is a sensitive one.

To meet the challenges and develop strong systems:

Banner: Banking smarter and safer. Let’s lead the future of finance with AI and ML-driven fraud detection systems. Connect Now

Commonwealth Bank’s AI-Powered Fraud Detection

Commonwealth Bank’s AI-Powered Fraud DetectionCommonwealth Bank of Australia encountered a rise in mobile transaction-based digital fraud attempts nationwide. Conventional rule-based systems were unable to recognize changing scam patterns.

Collaborating with a machine learning development company, the bank introduced sophisticated machine learning app development solutions coupled with AI app development. These models processed millions of live data points to detect suspicious behaviours in real time.

In the span of six months, mobile apps using artificial intelligence reduced false positives by 45% and enhanced fraud detection accuracy by 70%, serving as a benchmark for machine learning development in Australian banking security.

The Australian banking industry is redefining fraud detection, AI and ML to transform financial security into something more proactive, adaptive, and user-centric. By adding predictive intelligence, transaction patterns, and real-time alerts, on-demand app developers are helping financial institutions detect fraud prior to users. This development is a substantial breakthrough in data-driven decision-making and improved digital trust.

In the case of banks and innovators in the financial technology sector, the collaboration with competent on-demand app developers implies smarter, more secure and scalable mobile banking. It is time to adopt an AI-powered transformation with professionals who make your app future-proof, ensuring that your customers will not lose trust in any transaction.

Q 1. How do AI and ML detect fraud in banking apps?

Ans 1 AI and ML scan users’ behaviour, transaction patterns, and device data to detect anomalies. They learn what has been done in the past, which allows iOS app developers to create more intelligent, real-time fraud detection mechanisms.

Q 2. Why are AI-driven banking applications popular in Australia?

Ans 2- The current level of smartphone penetration and high technology of the digital sector in Australia creates the impetus to develop a secure artificial intelligence application that can significantly reduce financial fraud.

Q 3. Will AI fraud detection be available for small banks?

Ans 3- Yes, scalable AI application development solutions enable fraud prevention for smaller institutions.

Q 4. How can iOS app developers ensure data privacy?

Ans 4- Through the use of encryption, safe APIs, and following Australian data policies.