Quick Chat

with you!

You have our ear and we can't wait to hear about your idea! Share your details here and we will make sure to schedule a coffee date with you soon.

Do conventional fintech apps meet customers’ needs, accuracy and autonomy? As the Australian digital finance industry is in a boom phase and consumers demand more intelligent experiences, Agentic AI in Fintech is becoming the next great frontier beyond simple chatbots, fully independent payment agents that can anticipate needs, optimise processes, and minimise friction at each step. It is causing a skilled mobile app development company in Australia to re-evaluate how they build future-ready solutions. Australian banks are adopting smart fintech app development solutions to streamline payments and enhance customer experience.

In Australia, with one of the highest levels of fintech adoption globally, customer experience is not a differentiator but a need. Proactive teams are incorporating the features of artificial intelligence applications in products to automate loan approvals, identify fraud and provide personalised insights. Such capabilities enable the brands to remain competitive, compliant, and responsive to user demands.

This blog will dive into the manner in which the use of artificial intelligence leads to Agentic automation, the reasons why Australian fintechs need to invest immediately, and how a mobile app development company can facilitate the creation of safe, self-governing financial systems by 2026.

This part is suitable for fintech start-ups developing AI-based products, founders evaluating automation in payments and Australian businesses updating digital finance platforms. A reputable mobile app development company in Australia helps users understand feasibility, compliance, and scalability, informs product leaders considering autonomous workflows, and CTOs developing secure and future-proof architectures.

With the expanding integration of AI in the Australian fintech sector, the practical application examples are gaining more importance. The guide assists decision-makers in balancing the build-versus-buy solutions with a mobile app development company in Australia that explains how AI apps can facilitate intelligent, quicker and more adaptable financial services, which will help innovation and competitiveness in 2026 and beyond.

Agentic Artificial Intelligence in Fintech

Agentic Artificial Intelligence in FintechFintech Agentic AI is redefining financial app functionality, shifting rule-based automation to an environment where systems can think, make decisions, and take action. Now in Agentic AI Fintech, applications no longer work as a passive tool; instead, the application takes the initiative to handle payments, fraud detection, and financial decisions optimization on the fly.

It promotes transparency, security and regulatory compliance to ensure that Australian fintech applications grow responsibly and provide more intelligent, faster, and customer-centric financial experiences across digital ecosystems.

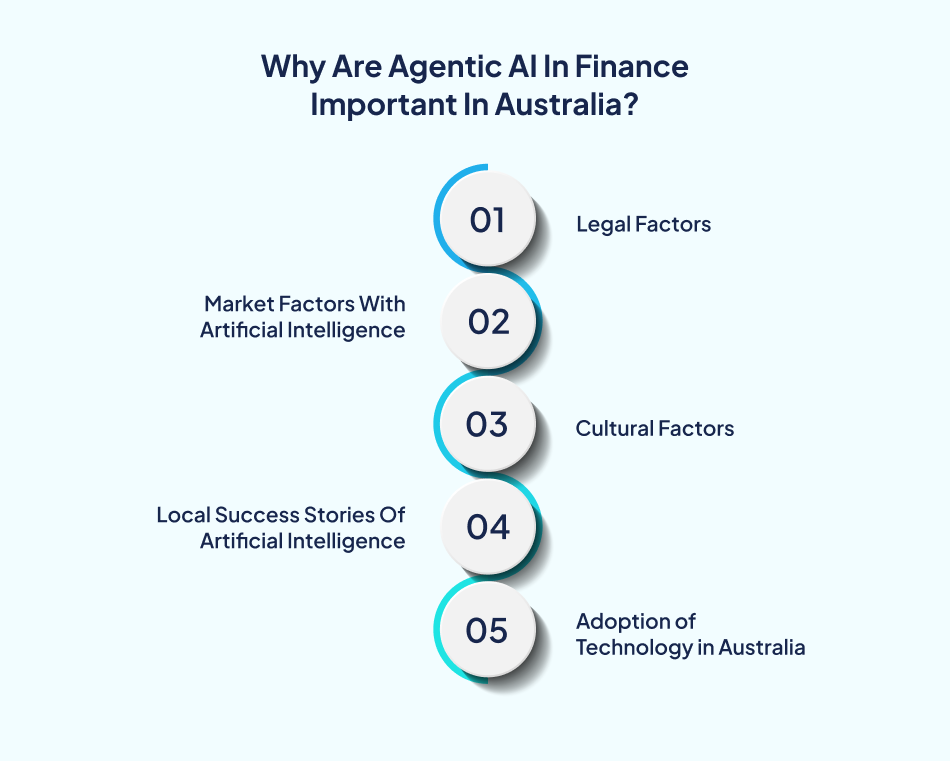

The reasons why Agentic AI in Fintech is important in Australia can shed light on the phenomenon that regulation, market maturity, and digital culture are driving autonomous financial innovation in Australia.

3. Cultural Factors

3. Cultural FactorsEarly fintech systems depended on simple automation and programmed conversation systems. The current AI chatbot is now capable of comprehending intent, context, and sentiment, providing a much more human-like experience.

This jump has necessitated significant progress in the development of AI applications, steered by every progressive artificial intelligence mobile app development company dedicated to fintech-quality security and compliance.

Advanced fintech application development practices are transforming the operational growth of organizations throughout the fintech ecosystem by Agentic AI-powered mobile solutions.

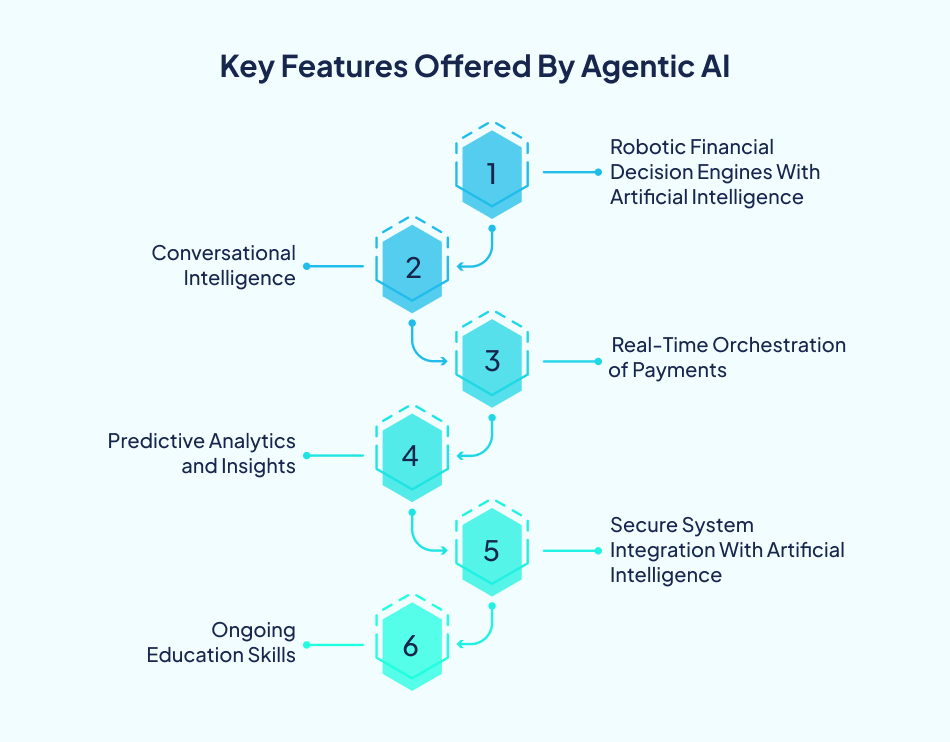

Using highly sophisticated AI app development, an intelligent AI application can examine user behaviour, transaction history, and risk profiles to take financial actions.

The natural conversations on a context-aware AI chatbot facilitate uninterrupted assistance and reinforce what clients perceive as the optimal AI chat experience within the framework of contemporary fintech applications.

3. Real-Time Orchestration of Payments

3. Real-Time Orchestration of PaymentsAutonomous payment execution through agentic systems designed through fintech application development enables balances, schedules, and predefined triggers.

Software developers in the fintech industry are utilising AI app creation to facilitate predictive analytics used in detecting fraud, cash flow forecasting, and spending behaviour.

A qualified artificial intelligence mobile app development company will guarantee secure connectivity between AI application models, banking APIs and compliance models.

AI chatbot developers create adaptive fintech apps that continuously train and make more accurate decisions over time. Banks are investing in AI-driven financial apps to improve accuracy and automate decision-making.

Intelligent fintech app development is enhancing the creation of business value in financial institutions by agentic mobile solutions.

Rapid data analytics provided by an AI application enable organisations to take precise and informed financial decisions in real-time.

One-on-one AI chatbot interaction enhances interaction, recommendation, and support, providing the ideal AI chat experience on fintech websites.

The ability to automate through AI-driven app development reduces manual workloads, enhances efficiency among fintech software developers and the operations departments.

Anomalies detected by AI-driven monitoring systems elaborated by fintech app developers Australia are detected instantly, which enhances security and trust.

Fintech organisations can scale safely and effectively with solutions provided by a reliable artificial intelligence mobile app development company.

Autonomous Payment Agents: The Next Leap

Autonomous Payment Agents: The Next LeapIn 2026, autonomous payment agents will be the norm. These agentic systems are a highly advanced AI application capable of triggering, approving, and reconciling transactions on behalf of users. Fintech programmers already create the payment structure activated by context, including subscriptions, travel, or inventory levels, in a secure fintech app development life cycle.

Although it has its benefits, agentic AI in the context of fintech app development is fraught with numerous difficulties.

Protecting delicate financial information is another primary challenge to fintech software developers who operate on AI application frameworks.

AI-based app development should adhere to current financial regulations, and the audit needs to be autonomous in making decisions. An Android application development firm helps you comply with the latest regulations.

Developers of fintech apps have to be transparent and accountable regarding the decision-making process of AI chatbot systems.

4. System Complexity

4. System ComplexityAn Artificial intelligence mobile app development company adds technical complexity in the development of agentic architectures.

The development of AI applications is a complex task that implies hiring skilled fintech software developers.

Having autonomy in the use of AI and retaining human control is paramount to entrustment.

The definition of digital finance will be redefined by agentic AI as fintech app development progresses towards intelligent agency.

Artificial intelligence-based payment agents will automatically handle transactions, subscriptions, and settlements.

The AI chatbot will become a proactive financial assistant, providing users with the best AI chat experience.

The application engines of AI will personalise financial journeys based on immediate behavioural measurements.

Banking, lending, and investment ecosystems will integrate agentic intelligence into fintech software developers. An Android application development firm can help you integrate AI into your app.

The development of AI applications will automate the process of compliance checks, reporting, and risk evaluation.

Companies developing artificial intelligence mobile apps and fintech app developers will dominate the market with scalable intelligent solutions.

Autonomous Payments: Transforming an Australian Fintech App

Autonomous Payments: Transforming an Australian Fintech AppThe objective of a mid-sized Australian digital payments company was to minimise delays in transactions, customer support and workload, as well as enhance trust and compliance.

Manual payments approvals and rule-based bots led to friction, delay in dispute resolutions, and an increase in operational costs during peak e-commerce periods.

Fintech embraced agentic AI-driven payment agents with the ability to analyse the context of transactions, identify anomalies, and make approvals. AI chatbots were advanced to voice-based and decision-making support.

The time to process decreased by 40% in six months, fraud challenges reduced, and the solution worked well across Android gadgets.

The future of agentic AI in fintech has already become a reality, as it is actively transforming the functionality of payments, security, and customer engagements in the context of modern financial applications. With intelligent AI chatbots and fully independent payment agents, businesses can build a platform that is not only more robust but also more intelligent and rapid. Together with a suitable strategy, on-demand app developers Australia have the freedom to offer secure solutions that will satisfy both users and the authorities.

Working with an established on-demand app developers Australia as you become more widely adopted will provide a solution with a future-proof, compliant and user-friendly approach. When considering agentic AI in your fintech product, it is high time to initiate the dialogue and turn intelligent automation into quantifiable business value.

Q 1: What is Agentic AI in Fintech?

Ans 1: Agentic AI enables fintech applications to take independent actions without relying on simple automation, but on a self-thinking payment and compliance agent.

Q 2: What are the advantages of the iOS app with agentic AI?

Ans 2: The expert iOS app developers incorporate agentic AI to provide scalable banking, foresight insights, and safe payment experiences on Apple devices.

Q3: Are agentic AI systems compatible with POS?

Ans 3: Agentic AI can indeed be easily linked with POS software to automate payments, identify fraud, and optimize real-time transaction flows.

Q 4: Is agentic AI the future of fintech apps?

Ans 4: Absolutely iOS app developers will integrate agentic AI with POS software to develop faster, more scalable and clever fintech platforms in 2026 and beyond.