5 Aug 2024

AI In Finance: How Artificial Intelligence Is Transforming The Financial Market In Australia

Shaun Bell

The crossroad between finance and artificial intelligence has proved to be a beautiful boon for people, providing unrivalled insight and automation into financial management. AI optimizes investments, personalizes advice, and facilitates better decision-making in financial services to make them more accessible, efficient, and tailored to the requirements of each individual.

Such synergy fuels innovation and economic growth. There isn’t a field out there that artificial hasn’t impacted with its brilliant capabilities to help make things convenient for everyday users by allowing them to gain access to 24/7 customer service. What starts from health care through the financial sector, AI increases efficiency, accuracy, and innovation.

The application of AI in data analysis, automation, and predictive modelling generally transforms industries by making processes more intelligent and responsive against dynamic needs. Artificial intelligence has disrupted various industries, but perhaps none more so than finance.

The finance industry, once ruled by manual processes and human judgment, now stands at the threshold of technological innovation. With the infusion of AI into the finance industry, it is bound to undergo a paradigm shift in how it functions—with enhanced efficiency, accuracy, and security.

Imagine a world in which the great wisdom of human experience and instinct in financial decisions is supplemented by the power of algorithms analysing massive amounts of data in real time. Artificial intelligence brought this reality into the realm of finance. Be it robo-advisors that provide personalized investment advice or fraud detection systems capable of spotting suspicious activities instantly, AI transforms how financial institutions run their operations.

Recently, AI-driven predictive analytics has also begun transforming risk management within the financial sector. Artificial intelligence (AI) systems can precisely forecast future hazards and opportunities by examining past data and looking for patterns. This proactive approach toward risk management enables a financial institution to avoid losses and capture new trends, giving it an edge over others in a fast-changing marketplace.

What Is Artificial Intelligence And Its Role In Finance?

The general definition of artificial intelligence (AI) is the emulation of human intelligence processes by any machine, especially computer systems. These processes can include learning—acquiring information and rules for using the information—reasoning—making rules to draw approximate or definite conclusions—and self-correction. In essence, AI systems can do what would otherwise be done by human intelligence, like visual perception, speech recognition, decision-making, and language translation.

AI in the financial sector has been a breakthrough, offering a bank of applications that enhance efficiency, accuracy, and decision-making. It primarily plays a primary role in data analysis and predictive analytics within AI in finance.

AI algorithms can run vast reams of data through at incredible speeds and come out spotting patterns and insights that no human could probably identify. Especially within stock trading, this capability creates most of the value.

Growth Of AI In Finance In Australia-

Growth in AI in finance in Australia has been remarkable, mimicking global trends in digital transformation within the financial sector. According to statistics, AI adoption in Australian finance is moving on an accelerated upward trajectory because of the ever-increasing need for better efficiency, customer experience, and risk management.

1. Investment in AI:

Australian financial institutions have increased investment in AI technologies dramatically. According to the 2023 Report by the Australian Banking Association, AI investment in the banking sector has grown at an annualized growth rate of 30% over the past five years.

2. AI adoption rate:

A cross-sector survey on AI adoption in 2022 by PwC Australia showed that 70% of Australian financial services companies had adopted AI in some form, while 40% intended to use more AI solutions within the next two years.

3. Improved customer service:

AI-powered chatbots and virtual assistants have become very common. As many as 60% of the banks are leveraging these technologies to process customer enquiries and transactions, thus dramatically reducing their waiting time and operational costs.

4. Fraud Detection and Risk Management:

AI in fraud detection and risk management has been transformational. According to a study by KPMG, AI-enabled systems helped banks in Australia reduce fraud losses by as much as 20%.

5. Regulatory Compliance:

AI is at work in regulatory compliance as well. As stated by Deloitte, 55% of financial institutions run on AI-driven compliance systems that smooth the process and reduce manual effort.

Growth After The Pandemic-

The growth in AI in finance for Australia after the pandemic is massive. Industry reports indicate that the internal adoption of AI technologies within the financial sector surged by over 30% from 2020 to 2023.

Investments in AI-driven solutions, including fraud detection and customer service automation, increased by 25%. Also, 40% of banks and financial institutions in Australia reported implementing AI-based analytics for risk management and personalized financial services. The surge is in the backdrop of building up better digital capabilities and operational efficiency due to the challenges of the COVID-19 pandemic.

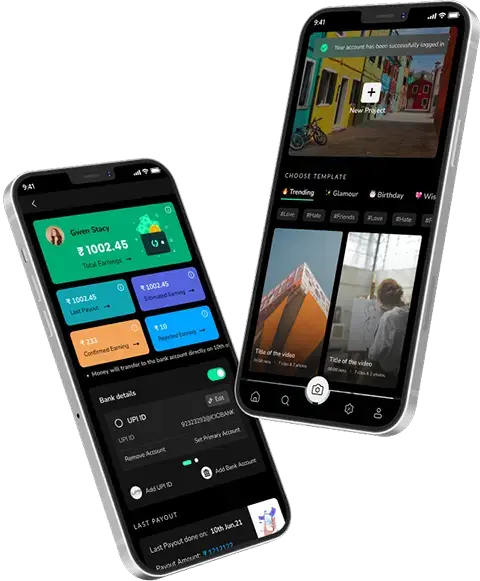

Types Of AI Integrated Finance Apps-

Artificial intelligence is revolutionizing the finance sector, from smart investment platforms to automated fraud detection. AI improves the efficiency and precision of financial services. The core types of AI-integrated finance apps are robo-advisors that provide personalized advice by algorithmic analysis on investment matters and predictive analytics tools that forecast market trends and financial risks.

It is supported by the fact that AI-driven chatbots make customer service effortless, while machine learning algorithms identify fraudulent activities in real-time. Developments in this field bring not only optimization of financial operations but also a much more personalized and secure user experience in today’s predominantly digital world.

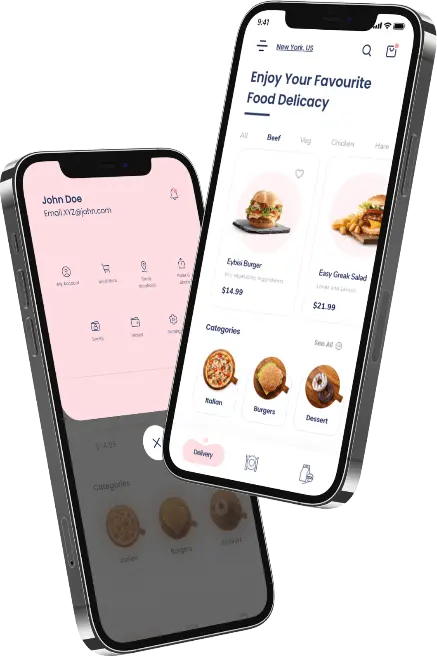

1. Personal Finance Management Apps–

Isn’t it great that you no longer need to twist and turn to find the receipts or late-night

financial calculations to help you budget for next month and examine your spending? Thanks to the invention of a personal finance management app, it can do everything for you, from expense tracking to budgeting, spending pattern analyses, and even investment recommendations.

The platform brings all your financial information into one place, automates your savings goals, and gives personally tailored advice on improving your financial health to empower control and insight.

2. Investment Management App–

Well, you no longer need to worry about investing in the right business without doing research for hours, thanks to investment management apps that have made it effortless to invest without the fear of failing.

An investment management application guides users through managing and optimizing their investment portfolios through real-time tracking, personalized investment recommendations, and analytics. It facilitates the process with the functionality of asset allocation, performance monitoring, and risk assessment—all combined to let users make informed decisions to achieve their financial goals efficiently.

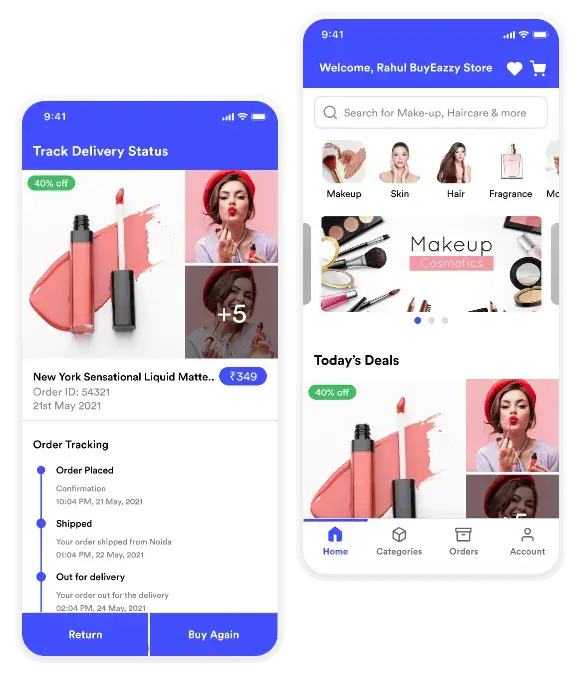

3. Fraud Detection Apps–

Isn’t it great that you no longer need to worry about getting scammed by people using your sensitive data with the invention of fraud detection apps that enable you to detect fraud beforehand? Fraud detection apps help trace and block fraudulent activities in all financial transactions through sophisticated algorithms and real-time data analysis.

Through machine learning and artificial intelligence, the app keeps track of the patterns of activities and any anomalies, raising flags against any suspicious behaviour instantly. It integrates with the banking system and various payment platforms to ensure its protection against several frauds, like identity theft and unauthorized transactions.

4. Credit Scoring Apps–

AI-driven credit scoring apps reimagine what risk assessment looks like, with algorithms analysing an array of input data that includes the following: traditional metrics on payment history and debt levels are evaluated alongside expenditure habits, social factors, and other non-traditional data.

AI will improve the accuracy by identifying patterns and making more accurate predictions regarding credit risk. Real-time updates and personalized insight into one’s credit score make it easier to understand and, thus, better manage financial health.

5. Expense Tracking Apps–

Owing to the development of expense-tracking apps, you no longer need to fret about tracking or managing your budget for the next month manually, as this app can do it for you. AI-driven expense-tracking apps automate and further intellectualize personal finance management using advanced algorithms that analyse spending patterns and categorize transactions.

The apps apply machine learning to give user-specific insights into spending habits, budget adjustment recommendations, and expenditure forecasts.

6. Financial Planning Apps–

Financial planning apps with AI integration can personalize guidance on finance by studying data from the user and making forecasts on future financial needs. Such apps, using artificial intelligence on the spending habits, income, and goals of the user, could offer an advanced level of customized advice on budgeting, saving, and investment.

AI-based algorithms forecast market trends and tell investor the best strategies to adopt to increase their average earnings. Often, the apps use real-time tracking mechanisms and other adaptive planning tools to adjust their recommendations according to financial circumstances.

7. Customer Service Chatbot–

Isn’t it great that you no longer need to spend big bucks to hire people for customer support? AI-empowered customer service chatbots have changed the scene of user support, now handled in real-time and round the clock.

These clever bots comprehend customer inquiries and respond intelligently by implementing natural language processing and machine learning techniques. Their roles range from answering frequently asked questions to dealing with complex problems. Personalization of support—chatbots retrieve user data and preferences for customized replies and proactive help.

Essential Applications Of Artificial Intelligence In Australian Finance–

Artificial intelligence is finding its way into the Australian finance sector through its striking applications, changing how financial services are conducted. Be it enhancing risk management or optimizing trading strategies, artificial intelligence is at the very frontier of innovation.

Notable applications include predictive analytics, realizing extraordinary accuracy in predicting market trends and customer behaviour, and automated detection of fraudulent activities by recognizing, in real-time, suspicious events.

1. Fraud Detection And Prevention–

One of the best things to happen after the integration of artificial intelligence into Australia’s financial sector is the prevention of fraud, as it allows individuals to detect fraudulent behaviour beforehand.

Fraud detection is one of the most grave challenges faced by a financial institution. Traditional methods are incapable of matching the ingenuity behind fraudulent activities. AI and ML offer various advanced tools for fraud detection and prevention through transaction pattern analysis, anomaly detection, and threat prediction. Australian banks, like

Commonwealth Bank and ANZ, use machine learning algorithms to boost fraud detection systems, returning an instant response and reducing financial loss. Furthermore, the system is constantly picking up new information from fresh data, which helps it adapt to new tricks and fraud schemes and become more precise.

It means that financial institutions have an easy time remaining resilient in the face of evolving threats and staying in a position of trust with their customers.

2. Risk Management-

It is pivotal to maintain stability and profitability through management of the financial risks of financial institutions. AI and ML assist in assessing credit, market, and operational risks by examining historical data and market trends. These technologies enable banks to make informed decisions, minimize risks, and optimize their portfolios.

Moreover, AI and ML can simulate several market scenarios to forecast possible losses and detect vulnerabilities in real time. It is the proactive approach that will then enable fast responses from financial institutions to changes in markets, improving their resilience and ensuring compliance with regulations.

3. Customer Service And Personalization–

Customer service in the financial industry is evolving thanks to AI-powered chatbots and virtual assistants. They respond immediately to customer queries, thus eliminating the waiting time and increasing customer satisfaction. Besides, ML algorithms analyze customer data to provide customers with more personalized financial advice, product recommendations, and targeted marketing.

These advanced systems can easily handle a broad spectrum of queries, from simple account information to complex financial advice, operating 24×7, thus providing customers timely assistance and building confidence, building a trust factor in the customer-bank relationship. If you desire to ensure your app is an instant success, hire a reputable mobile app development company to help you turn your dream vision into a reality.

4. Investment Strategies And Robo Advisors –

Artificial intelligence has brought about a sea of change in investment management with the aid of robo-advisors. These are the automated online platforms that render investment advice and portfolio management services in keeping with the individual’s preferences and risk tolerance.

On the market data, the ML algorithms examine and optimize investment strategies that can maximize returns for investors. It is a platform that makes investment more accessible by lowering fees and minimum investment requirements compared to traditional financial advisors.

In addition, these robots continue to monitor your portfolio, rebalancing to ensure that investments remain aligned with the client’s set goals and market conditions to help improve their overall financial well-being.

5. Regulatory Compliance –

Compliance with regulatory requirements is resource-intensive and labyrinthine for a financial institution. AI and ML make compliance seamless through the collection, analysis, and reporting of data in an automated manner.

Not only do these technologies help with compliance monitoring, but they also help detect regulatory changes and their eventual compliance. Artificial Intelligence-driven compliance solutions are increasingly used by Australian banks to help shave off avoidable costs and have resilience toward regulatory risks.

Key Technologies To Integrate In AI-Powered Finance App–

An AI-based finance application with all the key technologies integrated can bring a revolution in financial management. Machine learning algorithms provide personalized financial advice and predictive analytics for developing better decision-making. NLP empowers user interaction in a much more intuitive way through chatbots and virtual assistants.

1. Machine Learning –

The foremost technology you need to integrate into your finance app is machine learning because it is the core of AI-powered finance apps in their operations. They analyze copious amounts of data to dispense individualized finance advice that matches the user’s behaviour and preferences.

Predictive analytics uses historical information to project market trends and hence assists users in making informed investment decisions. The algorithms also enhance security by performing anomaly detection of transactions in real time for possible fraud signals or unusual activity.

2. Cloud Computing–

Another brilliant technology that you need to integrate into your finance app is cloud computing to help you manage massive amounts of data efficiently. Cloud computing provides versatile and scalable infrastructure pivotal in manipulating large volumes of financial data. With cloud computing, financial apps can increase storage and processing ability with demand, again without a massive upfront investment in physical hardware.

This scalability will ensure the app can handle fluctuating data loads and growing user bases. Furthermore, cloud computing enables access to financial information anywhere at any time. It helps people collaborate and make decisions in real time.

3. Blockchain Technology–

Blockchain technology is the backbone for safety, transparency, and tamper-proof transactions in a finance app. It creates a decentralized ledger wherein each transaction is irrevocably stored on several nodes, making it impossible to change records without easy detection.

Transparency like this aids in regaining the trust of users who can independently verify transactions. Blockchain technology is decentralized, meaning it has features that enhance security, meaning there will be no single point of failure and, hence, low probabilities of hacking or fraudulent activities.

Partner with a leading mobile app development company to gain access to the latest and most advanced technology, the best solutions, and expert advice to ensure your app stands out from its competitors in functionality, design, and performance.

4. Biometric Authentication–

Biometric authentication strongly enhances the security of finance apps because it uses users’ unique physical characteristics to authenticate the user’s identity. A list of features, including fingerprint recognition, facial recognition, and voice verification, tightens the security measures that are hard to reproduce or fake.

Fingerprint scanners grant fast and accurate access to apps via the unique patterns on the tips of fingers. Facial recognition will look at unique facial features to allow access, and voice verification will do so based on the unique qualities of one’s voice. Both of these technologies increase security by having multiple layers of verification and ease of access for the user by being password-free.

5. Advanced Encryption–

Advanced encryption should protect sensitive financial information and guarantee users’ privacy protection. It applies complex algorithms to encode information so that it can’t be read by unauthorized entities. By preventing breaches or unauthorized access, this protection maintains the confidentiality of user information and financial activity.

A reputable artificial intelligence mobile app development company can help you develop smart and scalable applications to boost customer engagement, operational efficiencies, and business insights that differentiate your value from your competition.

6. Robotic Process Automation

Robotic Process Automation is a process where software robots, known as “bots,” repeat any predefined rule-based activity. RPA in finance apps will automate activities such as data entry, transaction processing, and the generation of reports. In doing so, this technology enhances efficiency, reduces errors, and frees human resources for higher strategic activities.

Moreover, high transaction volumes can be processed at a high speed by RPA, increasing overall operational efficiency and allowing real-time processing, thus bringing cost reduction and productivity improvement.

Benefits of Integrating AI Technology in Finance Apps–

AI inclusion in your finance app will change everything, from user experience to operational efficiency. From predictive analytics to personalized recommendations, AI-driven security features ease financial management and offer customized insight and better decision-making capabilities in one’s interaction with finances.

1. Improved Operational Efficiency and Productivity:

The best part about integrating AI into your finance app is how it boosts your app’s efficiency. It does this by focusing on strategic initiatives and providing an overall brilliant experience to the users rather than having you repeat each task. Artificial Intelligence in finance apps improves efficiency and productivity by automating tasks like data processing and managing transactions.

It reduces manual errors, increases speed, and relieves human resources to handle more complex tasks. AI-driven insights further smoothen decision-making to optimize the overall workflow and use of resources.

2. Better Decision Making

The ability to provide users with data-driven insight, customized solutions, and predictive analysis so that they can make the right decisions is another fantastic feature of AI integration in banking apps.

AI in finance apps enables better decision-making by trawling through heaps of data to provide actionable insights and predictive analytics. These AI algorithms capture trends and patterns, thus giving personalized recommendations and forecasts that help users make more informed and better financial decisions, leading to better results and strategic planning.

3. Greater Accuracy And Precision -:

AI finance applications provide accuracy and precision in analyzing vast data sets with complex algorithms. AI has a high order of reliability in spotting trends, predicting, and identifying anomalies. It reduces human error and provides accuracy in decision-making. This improves accuracy in suggestions for financial forecasts, risk assessment, and personalized recommendations.

4. Scalability–

AI-empowered finance applications robustly boost scalability by letting the app handle rising data and user volumes efficiently. Because AI algorithms can reassess heaps of financial data in real time, demand can be increased without performance degradation. In an environment with growing user bases and escalating data complexity, AI-driven systems would be dynamically readjusted to realize high service levels through optimally assigning resources so that the app remains responsive and reliable for uniform performance, with steady insights even as demands change.

Key Features to Provide within Your AI-Powered Finance App–

The rapid growth in the development of financial technologies opens up an excellent avenue for unique value addition to AI-powered finance applications aimed at driving up user experience and operational efficiency. Knowing how AI transformations would help you design an app that meets current demands and foresees needs in the financial landscape.

1. Login/Sign Up–

Another common feature in all financial applications is the ability to register or log in, and then the detailed user information associated with the details of the user’s preferences for the various monetary tools.

This way, users can log in to the benefits of the app and maintain some personal data information about themselves, such as names, telephone numbers, physical addresses, and preferred products. Such information can offer target customers a personalized experience on the platform.

2. Personalised Financial Insights–

AI-driven financial apps personalise their financial insights by using artificial intelligence, whereby the apps offer customized advice after analysing users’ data. These machine learning algorithms use spending habits, investing history, and even financial goals, among many others.

The app is thus capable of custom recommendations, budgeting tips, investment opportunities, and saving strategies, among others, about the user’s unique needs and objectives. It makes for better user engagement and the creation of more financially informed users with a personalized nature.

3. Account Management–

This AI-powered finance app creates a system of automated, personalized finance oversight in account management. It brings transparency to account balance visibility, transactions, and expenditure patterns in real time.

AI-powered tools categorize expenses, set budget goals, and give actionable advice to users, thereby streamlining financial management and giving better control over finances by providing personalized recommendations. A leading mobile app development company can help you transform your idea into a reality by helping you understand the market trends.

4. Expense Tracking:

If you’re going to develop an app in finance, you need to provide users with an expense-tracking feature so they can easily monitor their finances. This feature of the AI finance app is expense tracking for the categorization and analysis of user expenditure.

Machine learning algorithms allow for the accurate categorization of transactions and expenditure patterns, providing more insights into budgeting. It is achieved through real-time access to spending information, provided through effortless visual summaries and trends, thus allowing consumers to make an educated financial decision.

5. User-Friendly Interface–

A finance app integrated with artificial intelligence technology will power clean design and be intuitive, easy to use, track real-time data, and visualize transactions, expenses, and budgets in lucid graphs and charts.

It provides customized solutions and timely alerts that help you plan better through tailored notifications and spending and budget analysis.

The program can be customized with real-time voice, chat support, and parameters that can be adjusted based on how likeable a user is. Because it’s simple to integrate with artificial technology, all tracked data is correct, making it a comprehensive approach to financial management.

6. Push Notifications–

The most pivotal thing for an owner of a finance app to remain in business is keeping a targeted audience interested, and it is more effortless to do so with a push notification service.

Push notifications on an AI-driven financial app will update users on all activities around the clock, which helps improve engagement and responsiveness. AI will make such notifications more personified while considering user behaviour and preferences. It can provide alerts to pivotal market changes, transaction anomalies, and personal finance milestones.

7. Bill Payment–

This AI-based finance app simplifies the scheduling of any bill payment, whether utility or subscription-based, by recognizing one’s trends in payment and due dates to pay corresponding amounts on time. In this way, one remembers with notifications and can set up recurrent payments that avoid late fees.

8. Customer Support -:

AI-enabled finance applications provide real-time customer support by engaging with the latest technologies of chatbots and virtual assistants. AI-driven support can answer customers’ queries instantly, thus guiding financial management activities. It can efficiently manage routine inquiries and, where necessary, escalate complex issues to human agents for resolution.

Future Of AI In Finance-

The future of finance apps integrated with artificial intelligence technology gives way to a sea change in financial well-being. Such apps would take real-time financial data gathered by artificial intelligence and make appropriate financial insights and interventions possible.

1. Advanced Predictive Analysis –

Advanced Predictive Analysis in AI-integrated finance apps comprises machine learning and massive data analysis to predict market trends and financial consequences. Such apps scan vast historical data, real-time transactions, and economic indicators to predict market trends, thus optimizing investment strategy and personalizing financial advice.

This prediction enhances decision-making, minimizes risk, and maximizes returns. Such apps, with advanced AI technology, will be much more adept at spotting patterns and adapting to new data in providing relevant actionable insights, revolutionizing in a critical way how individuals and businesses approach and go about financial planning and management.

2. Ethical AI And Responsible Use

Transparency, fairness, and accountability are the core of ethical AI and responsible use for the future of AI-integrated finance apps. With AI having so much influence on the provision of financial services, algorithms should not be biased, and decisions should be explainable. Some of the ethical AI practices include safeguarding user data, avoiding bias, and remaining in regulatory compliance. Here is where these principles will contribute to lowering the risks connected with AI-driven decision-making while enhancing consumer confidence and trust in finance apps.

3. Collaboration With Fintech Start-up-

Partnering with fintech start-ups is very critical to the future of AI-integrated finance apps. Most of the time, innovation is driven by start-ups, which traditional banks lack. Through AI, these apps can provide more tailored financial services, predictive analytics, and enhanced security features. Real-time data processing and automatization of monetary decisions are possible with AI, hence improving user experiences.

Such collaborations offer the rapid development of the most innovative solutions and deployment, which is needed to make financial management more approachable and efficient. In this changing landscape of Fintech, such partnerships would be critical in shaping the future of finance, leading to growth while meeting changing consumer needs.

Conclusion–

In other words, AI undoubtedly has huge transformative potential over Australia’s financial market. Advanced machine learning algorithms and data analytics can be implemented in decision-making, risk management, and customer experience.

These AI technologies—predictive analytics, natural language processing, and algorithmic trading—are changing the face of finance in ways never before witnessed. 7 Pillars, an artificial mobile app development company can help you design an app that outperforms and is engaging, using cutting-edge technologies to fast-track your development process. Since they specialize in integrating the newest AI features, they ensure new solutions tailored to your needs, improving functionality and delivering extraordinary user experience.

Our technocrats at 7 Pillars, a mobile app development company can turn your idea into a reality by leveraging advanced technologies and industry best practices: empowering AI, intuitive design, and robust development frameworks that bring your vision into a workable high-performance app tailored to special needs.

Partner with our mobile app development company to build your vision into a state-of-the-art app. We deliver innovative solutions with exceptional user experience, ensuring your idea stands apart in the competitive marketplace.

So if you are an entrepreneur looking to develop a brilliant finance app that is an instant hit in the market, get in touch with our team at 7 Pillars, a leading mobile app development company today.