Quick Chat

with you!

You have our ear and we can't wait to hear about your idea! Share your details here and we will make sure to schedule a coffee date with you soon.

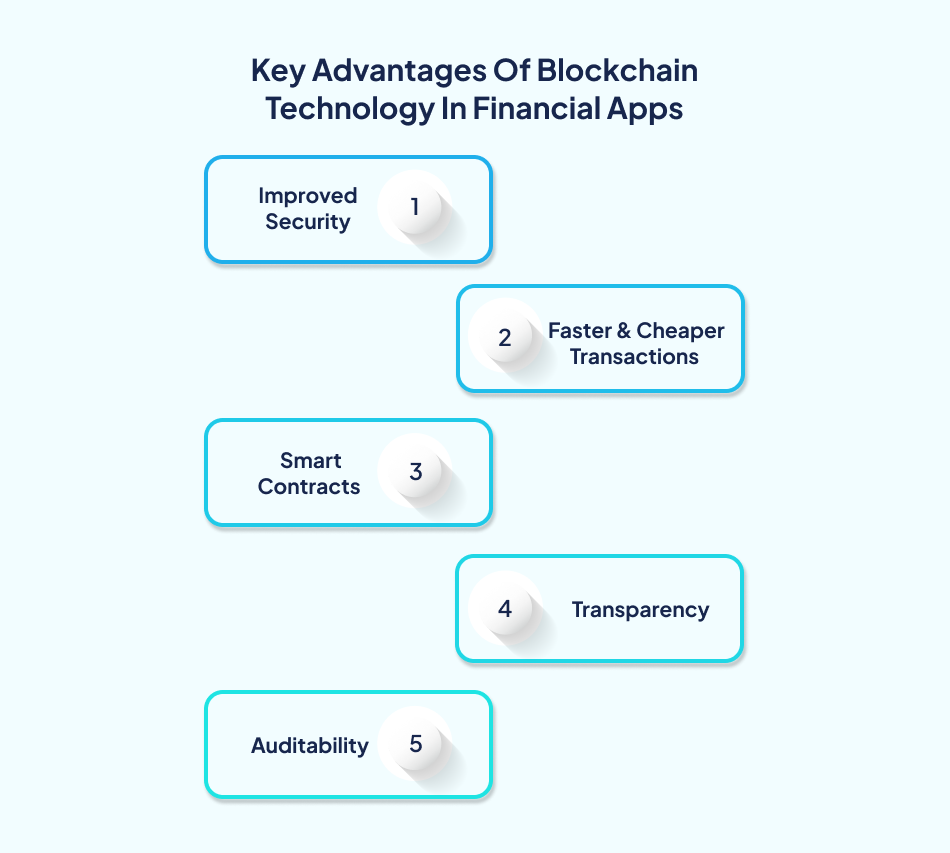

The primary focus for today’s fintech and users alike is security, and that is where blockchain comes in. Cyberattacks are on the rise globally, and Australian users expect their digital transactions to remain secure. That is why businesses are turning to blockchain application development companies to construct trust-first financial apps with a reduced opportunity to tamper with data. Finance brands are adopting advanced mobile app development services to deliver faster, safer, and more user-friendly digital experiences.

In Australia, the trend is even more urgent. Market insights indicate that over 72% of fintech in Australia will integrate blockchain within the next three years to guarantee transparency, audibility, and user protection. This trend exists because developing a blockchain application will serve Australian businesses and organizations to more securely future-proof their platforms and financial transactions – all while meeting the tightening data-security guidelines.

This blog dissects how blockchain technology in financial apps evolve from secure identity management and fraud-proof financial transactions, and what is leading fintech founders, start-ups, and Australian enterprises to consider it now to lead the space and their users.

This guide is for Australian founders, digital product managers, and businesses seeking to enhance their fintech offerings with next-generation security frameworks. Suppose you are mulling over the idea of a blockchain application development company helping to create a financial platform that is not only secure but also increases transparency.

It could also be helpful for teams comparing long-term reliability with new blockchain technology that is supported by the assurance standards. You may be a start-up undertaking the delivery of your first secure fintech app or a scaling business working with a second blockchain development application company. In either case, you will find that this guide helps clarify how blockchain technology and assurance support an increased user trust, compliance and transaction safety.

The Rise of Blockchain Technology and AI in Modern Financial Ecosystems

The Rise of Blockchain Technology and AI in Modern Financial EcosystemsBlockchain has transformed financial applications mainly through the facilitation of transaction security and the reduction of intermediaries. In banking and fintech, the technology is used as a tool for fraud prevention and also a means for users to have control over transparency. With the progress in AI, banks are now using a combination of blockchain and AI to develop software that can automate risk scoring and detect unusual behaviour.

Australia’s fintech market, estimated to be worth billions, is now driven by secure digital payments, open banking frameworks, and sophisticated blockchain app development services, which encourage speedy and user-first banking experiences.

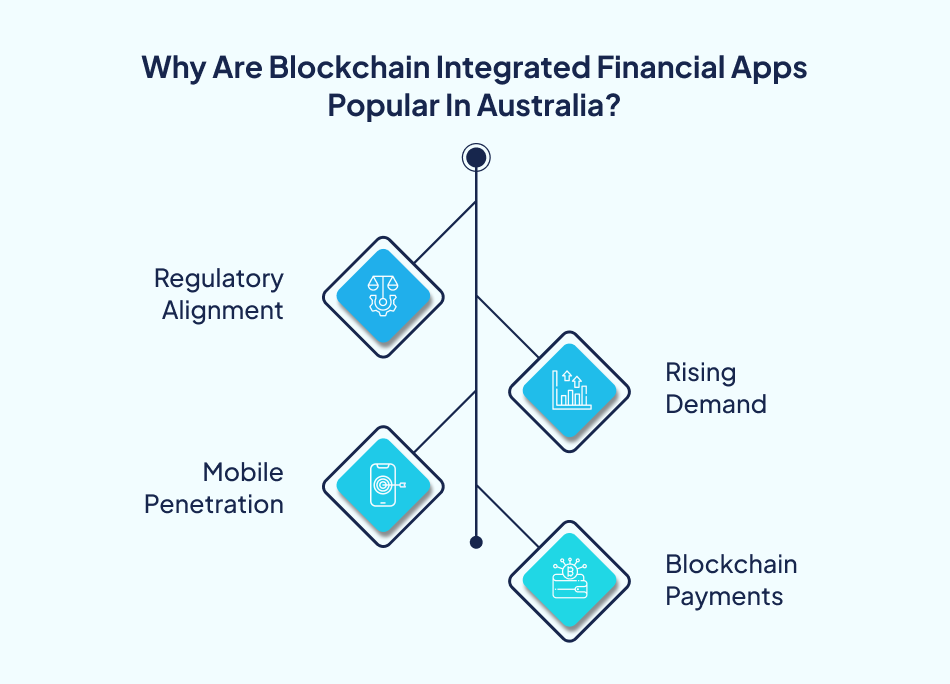

Australia’s advanced digital consumer market offers favourable conditions for blockchain in financial apps. High internet usage, widespread mobile access, and a technology-optimistic population are driving the adoption of secure, next-generation systems.

3. Impact of Mobile Penetration on Blockchain Payments

3. Impact of Mobile Penetration on Blockchain PaymentsFinancial apps have evolved from simple money transfers to advanced ones. Users now expect better security, instant settlement, and smooth digital experiences. It is where blockchain technology comes in handy. Blockchain technology involves the secure distribution of data among nodes, creating tamper-proof records as opposed to a centralized model.

Blockchain technology is changing financial service functions. It has the capability of making processes more secure, efficient, and transparent, therefore, leading to increased customer engagement and trust.

3. Smart Contract Functionality With Blockchain Technology

3. Smart Contract Functionality With Blockchain Technology New financial technology solutions are combining AI software development with blockchain technology, and rules can be executed without human intervention. For example:

4. Compliance With Blockchain Technology

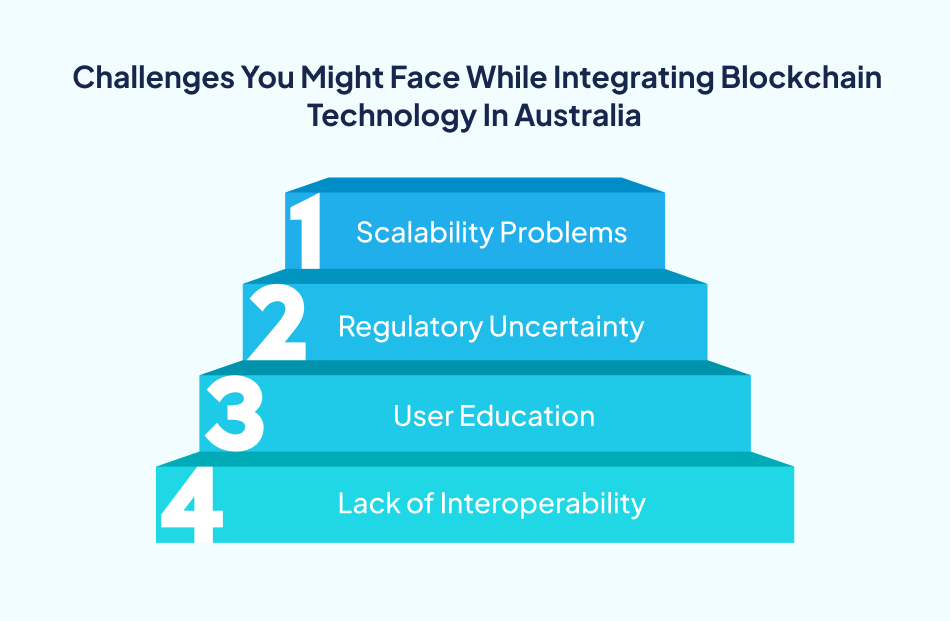

4. Compliance With Blockchain Technology  4. Lack of Interoperability

4. Lack of InteroperabilityThe future is likely to herald even greater adoption of blockchain technologies in the financial sector. Developments such as central bank digital currencies (CBDCs), identity systems, and biometric security are being implemented to enhance the automation of audits in the market.

As regulators produce a more explicit and transparent framework, the adoption of blockchain will combine both favourable conditions and cooperation between governments, fintech firms, and every blockchain application developer globally.

Advances in AI technologies will also improve fraud detection, risk assessment, and transaction monitoring across blockchain technology networks. The next-generation financial system will rely on automation, transparency, and interoperability, all of which are essential features of a powerful blockchain app.

Conclusion

Conclusion The movement towards smarter, automated data-safe mobile solutions illustrates the growing trend for businesses to take on-demand app developers in building systems that are agile, scalable, and future-ready. In this blog, you have seen how blockchain, AI and modern frameworks are transforming financial apps by improving transparency, eliminating fraud, and enabling more rapid transactions in markets where precision and compliance are essential.

Aligning with an experienced on-demand app development company will give you a competitive edge with secure architectures, user-friendly UX, and robust integration on your financial app in a digital economy that is moving faster than ever. You can get in touch with us today for a session centered around your strategy and tailored to your goals if you wish to enhance your financial app or add advanced technology with the help of a specialist.

Q 1. In what ways do blockchain features benefit financial apps?

Ans 1- Blockchain ensures records are safe, unchangeable, and thus can be processed faster, apart from offering more transparency, which is the cause of improved security and trust both to the user and the business.

Q 2. Why is it critical for a business to hire iOS app developers for its fintech app?

Ans 2- Experienced iOS app developers ensure the finished app will have a secure architecture, have optimal performance, and be ready for compliance with apps focused on finance and blockchain solutions.

Q 3. Can AI features be used in a mobile banking app with a blockchain?

Ans 3- Yes, while AI provides fraud detection and automation, blockchain provides data integrity.

Q 4. Can iOS app developers provide decentralized finance features in financial apps?

Ans 4- Experienced iOS app developers can include a wallet, a smart contract, and a secure identity layer for a DeFi-ready application.